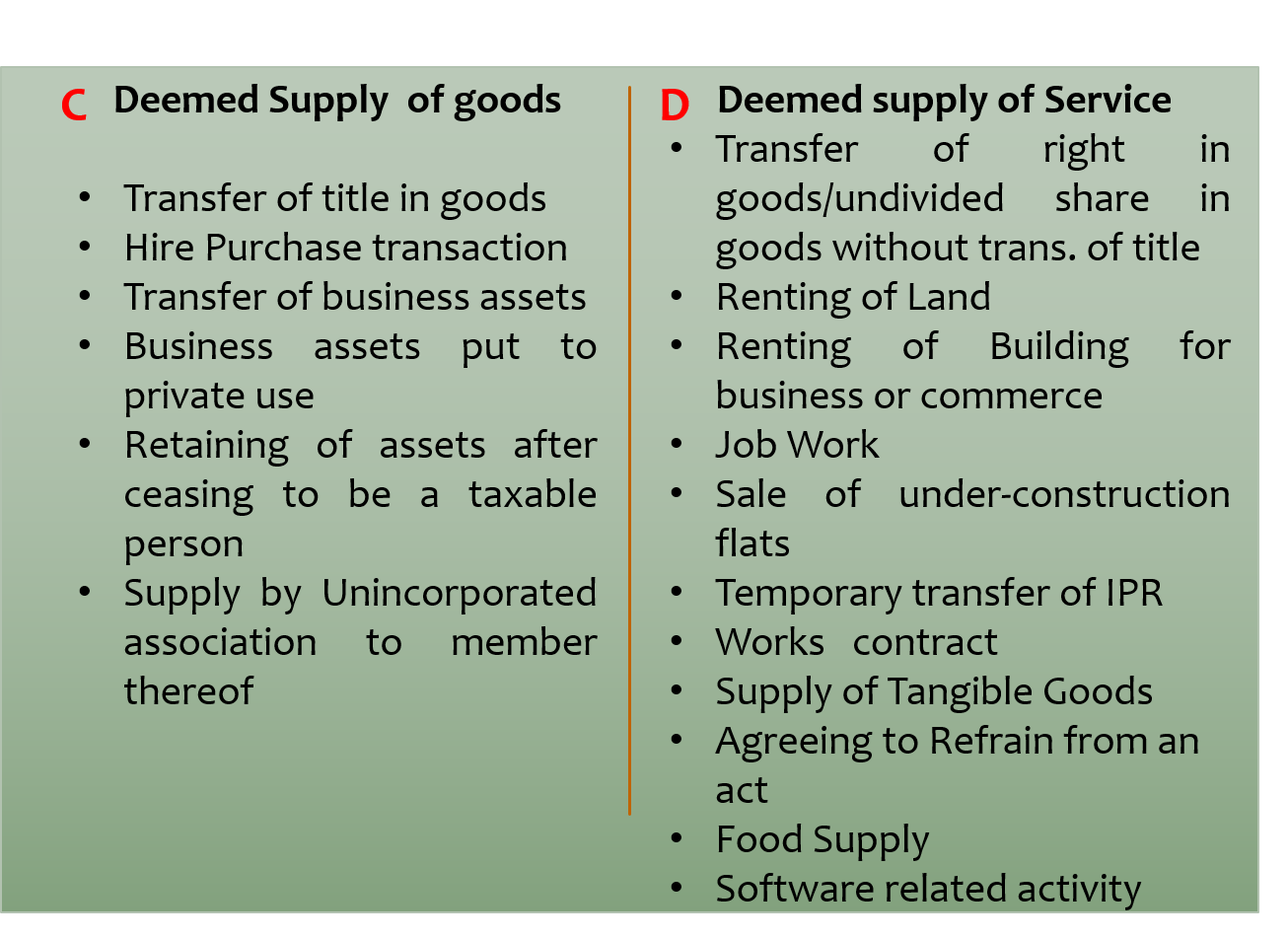

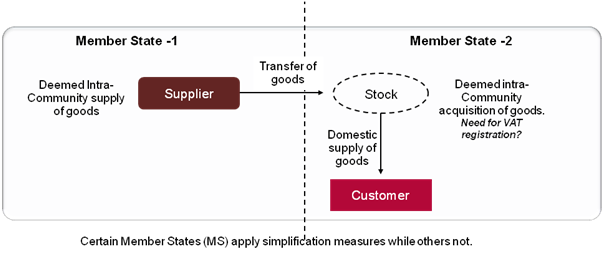

Nexdigm - With #Oman #VAT implementation on the horizon, the businesses must evaluate the compliance requirements. #DidYouKnow which supplies would be considered as deemed supply of goods under Oman VAT? Read through

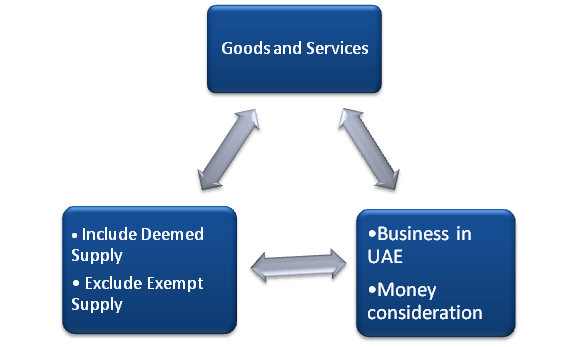

Indirecteducation on Twitter: "Taxable Event under GST i.e. #SUPPLY (Briefing the Scope of Supply under #GST) #concept #GSTSimplified #GSTinformation #indirecteducation https://t.co/bt9Im1TweC" / Twitter

We Are Open: Superior Industrial Supply is Deemed Essential Infrastructure Support - Superior Industrial Supply | Blog | Hose, Accessories, Fasteners, Industrial Supplies in St. Louis Region